RISK MANAGEMENT

Moscow Exchange Group admits that climate change poses risks to business continuity that may have long-term economic, environmental, and social implications for many sectors of the global economy, society, and the Group companies.

As part of its risk management system, the Group regularly identifies and assesses business risks in terms of their likelihood and expected financial losses. Moscow Exchange continuously monitors the legal environment and introduces international best practices to identify and assess climate risks and incorporate climate-related disclosures in its reporting.

Under the business continuity management system, a list of climate risks is compiled and factored in to strategic and financial planning. Moscow Exchange regularly assesses the impact of climate risks on trade and investment portfolios.

Key processes of the climate risk management system:

- compilation of a list of risks and opportunities, categorised and prioritised;

- assessment of the likelihood and impact of the risks identified;

- scenario analysis of risks and opportunities;

- updating the heat map of risks and opportunities;

- climate related metrics monitoring;

- monitoring the implementation of risk mitigation measures.

In line with the TCFD’s recommendations, Moscow Exchange distinguishes two main types of climate risks:

- Physical climate

risks – risks associated with natural phenomena arising from climate change. They are divided into acute risks, related to sudden events, and chronic risks, linked to long-term changes in climatic characteristics and conditions. - Transition climate

risks – risks connected to the shift toward a low-carbon economy, including measures taken by governments and regulatory bodies to mitigate climate change.

Physical risks involve potentially significant damage to premises and infrastructure, and harm to employees of the Group, its customers and partners, disrupting their businesses and resulting in financial losses that may prove critical.

Transition risks are divided into policy and legal, technology, market, and reputation risks. Each type may have significant financial implications for the Group’s business.

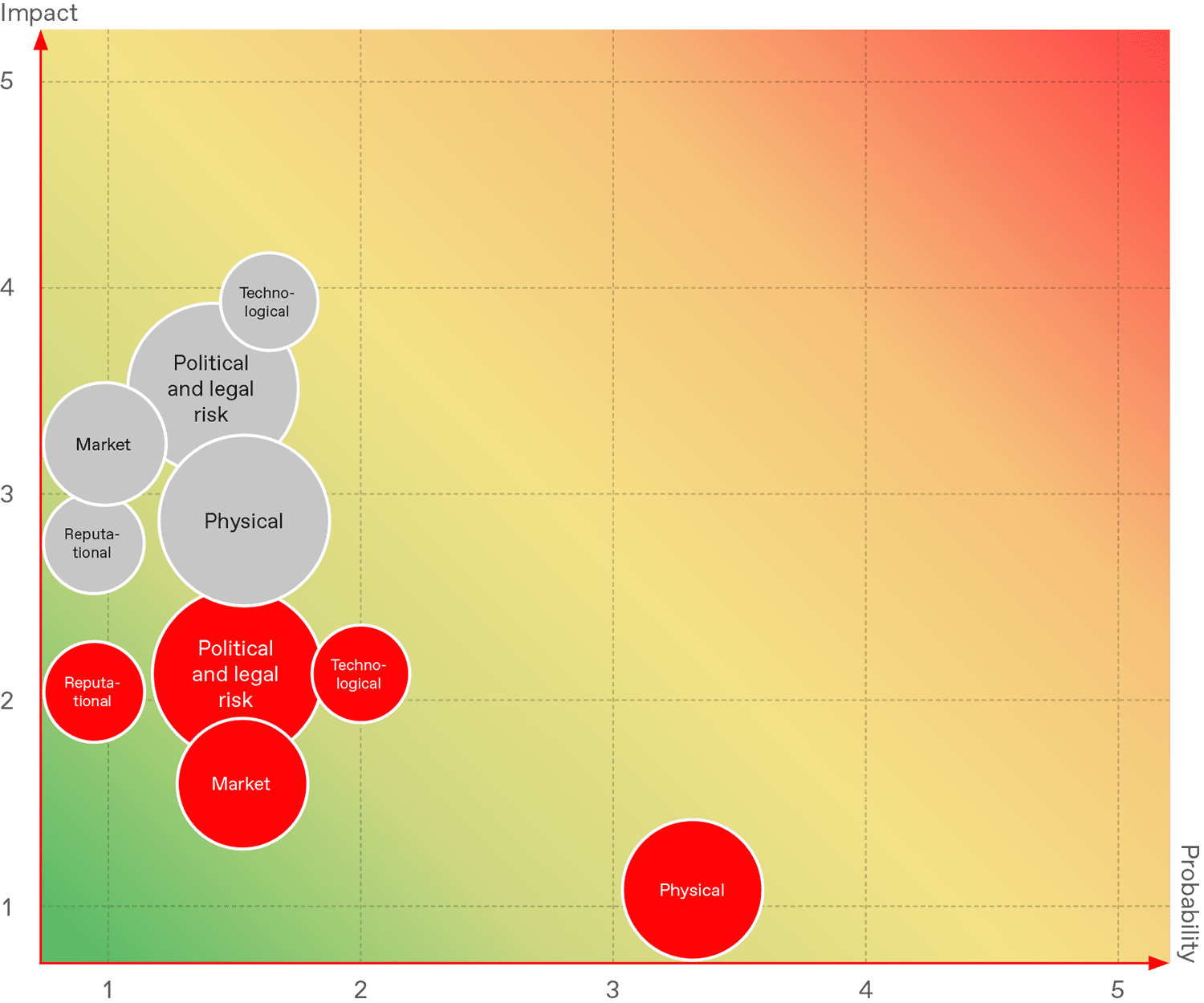

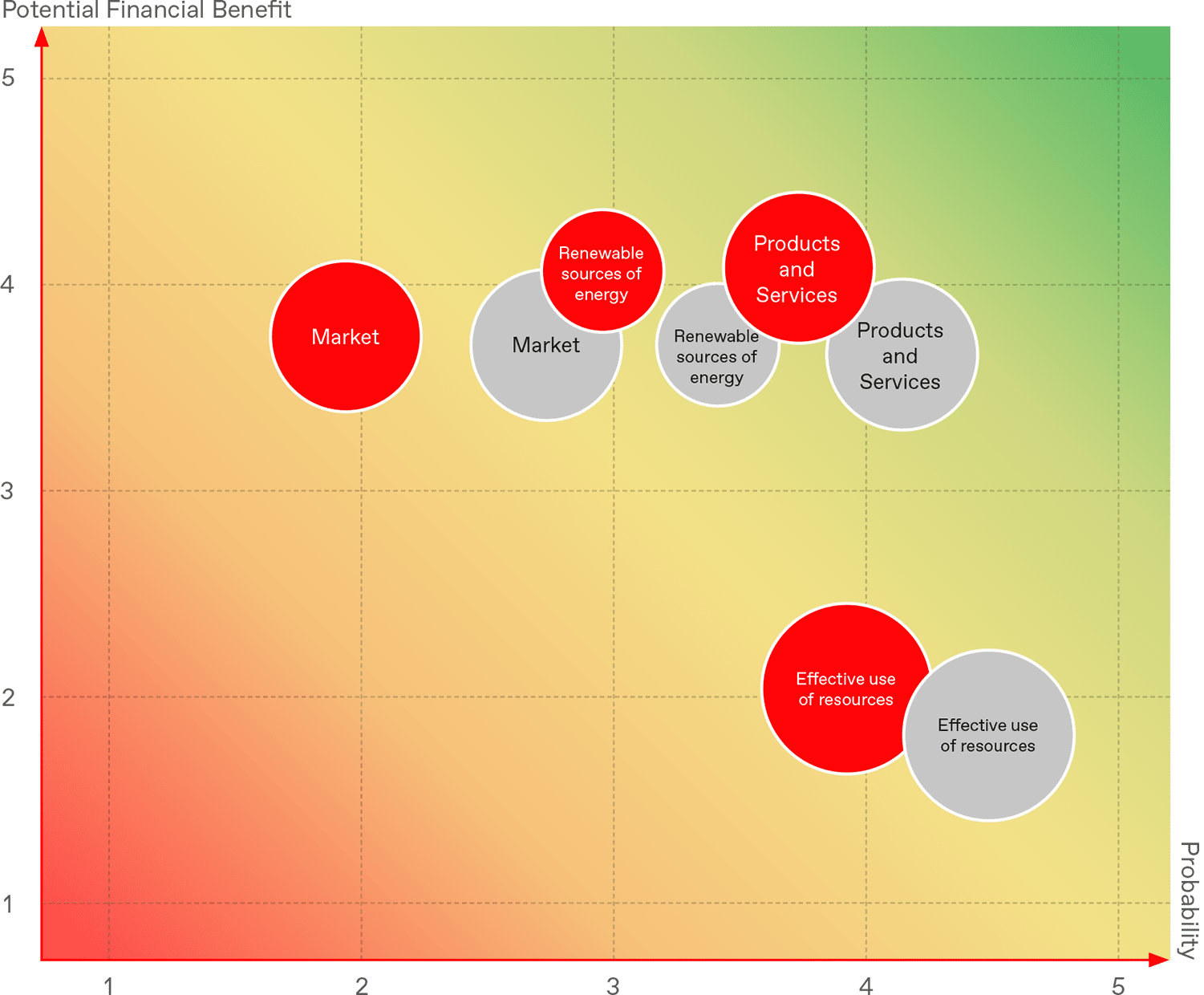

In 2024, the Exchange continued to improve its climate risk assessment model by estimating each risk probability and the expected losses. In order to do that all climate risk were divided into five types: market, policy and legal, reputational, physical, and technology (see the table “MOEX Group climate-related risks for a detailed description of the types of risks”). For all types of climate-related the degree of potential financial impact was determined and events (risks) of small and large magnitude were identified.

The financial costs for addressing climate risks and achieving climate opportunities mainly consist of staff costs for the areas responsible for climate action to some extent. The exceptions are the costs of commissioning contracts for the purchase of electricity from renewable sources of energy, not exceeding RUB 2 million.

Climate risks | Impact | Probability of small/large-magnitude risk | Response to risk or risk mitigation measures |

|---|---|---|---|

Physical risks | |||

Acute risks | |||

Floods, snowfalls | Changes in precipitation and extreme variability in weather patterns, including floods with destruction of roads, bridges, power lines, buildings, and other infrastructure, resulting in loss of life or injuries and leading to business shutdown | Average/Low | Disaster recovery strategies include:

Employees who work in the office, will be recommended to stay at home |

Freezing rain | Power failures (ice-covered power lines become extremely heavy, causing line supports, insulators, and lines to break). Traffic delays due to icy roads. Potential loss of life or injuries | Average/Low | |

Hurricanes, storms | Destruction of power lines, residential buildings, and other infrastructure, with loss of life or injuries and leading to business shutdown. Traffic delays | High/Low | |

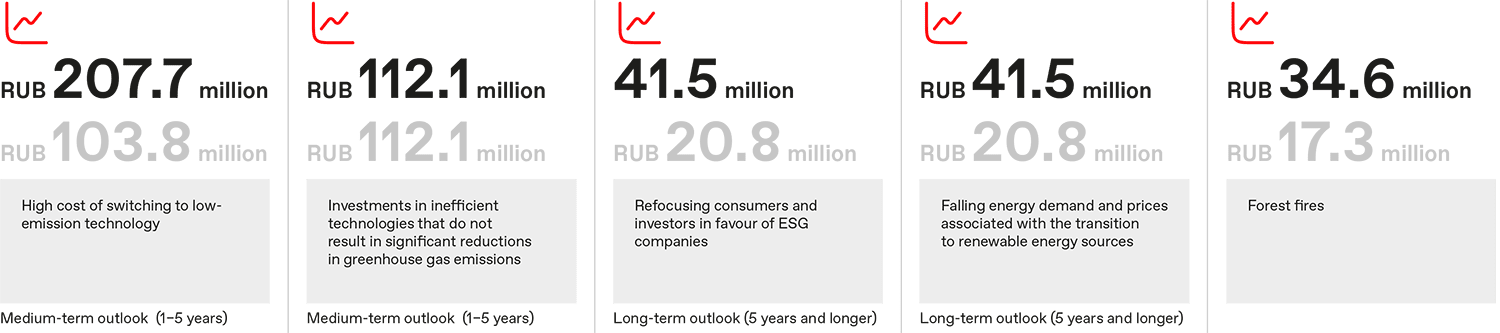

Forest fires | Destruction of property. Release of hazardous chemicals due to wildfires has a significant adverse impact on human health | Average/Average | Employee relocation plan will be rolled out in the event of forest fire emergencies |

Chronic risks | |||

Ice-crusted ground can lead to injury Ice-crusted ground | Ice-crusted ground can lead to injury employees and their incapacity | High/High | Employees who work in the office, will be recommended to stay at home |

Extremely hot weather | Adverse impact on employee health and operability of equipment Lower productivity | Average/Average | Providing a comfortable workplace environment: workplaces in air-conditioned offices will be offered to employees working from home without air-conditioning |

Extremely cold weather | Adverse impact on employee health and operability of equipment, resulting in slowdown or shutdown of operations | Above average /Average | Providing a comfortable workplace environment: employees working in the office will be permitted to stay at home. Employee relocation plan will be rolled out if extremely cold weather is followed by a central heating shutdown |

Transition risks | |||

Policy and legal risks | |||

High power costs | Energy prices rising faster than inflation as a result of abrupt transition to zero-carbon power generation | Average/Average | Wider use of energy-efficient equipment |

Enhanced emissions-reporting obligations | Additional financial and labour costs to collect information and report greenhouse gas emissions and their reduction | Average/Above average | Establishing carbon reporting procedures, participating in the CDP national and international carbon reporting initiatives. Engaging consultants for carbon reporting |

Inaccurate or false emissions disclosures | Fines and reputational damage: this is a developing area with new rules and disclosure standards, such as the TCFD’s Recommendations or the EU SFDR, including at the national level (Russia supports the implementation of new climate-related reporting rules along with requirements introduced this year) | Below average/ Below average | |

Higher exposure of issuers to litigation | Increased legal costs and expenses, including court-imposed fines | Below average/ Below average | |

New requirements for greenhouse gas emissions disclosures hindering placement of securities | Additional costs for maintaining a dedicated database of greenhouse gas emissions and preparing reports. Additional equity placement requirements | Average/Low | Coordination with issuers of changes in listing requirements concerning the reporting in the field of greenhouse gases |

Lack of clear regulatory targets for carbon emissions | Multiple possible interpretations of laws and regulations. Increased risk of non-compliance | Below average/ Below average | Coordination with issuers of changes in listing requirementsconcerning the reporting in the field of greenhouse gases |

Technology risks | |||

Costs of transition to lower-emissions technology | Failed investments in new technologies. Costs of setting up new business processes. Increased capital expenses for MOEX transitioning to low-carbon technologies. | Low/Low | Options for hedging financial risks associated with transition to low-emission technologies |

Power outages and emergencies due to low system resilience | Temporary power outages due to insufficient power storage capacity and lack of upgraded power grid services (resulting from a rapid and widespread transition to renewable energy sources). Power outages are expected to become more common at some point during the transition to lower-carbon technologies | Low/Low | Recovery strategies for a prolonged power outage at a single location include:

|

Failed investments in new lower-carbon technologies | Purchase/investment in inefficient new equipment/technologies can necessitate repurchases / investments, taking into account the requirements reduction of emissions | Below average/ Below average | Options for hedging financial risks related to investment in high-risk lower-carbon technologies |

Market risks | |||

Refocusing consumers and investors in favour of ESG companies | Shifts in consumer preferences. Reduced demand for services not meeting climate goals due to changes in investor behaviour | Low/Low | Introduction of ESG requirements for issuers and control over their implementation |

Lower energy prices as a result of energy transition | Decrease in demand and prices for energy leads to a drop in the income of the exporters and the loss of their capitalisation, which leads to lower commission new income. | Low/Low | Options for hedging financial risks associated with depreciation of assets |

Increased tax expenses of issuers (carbon taxes/allowances) | Changes in the terms of carbon taxation, including increased tax rates, may lead to increased tax costs for issuers | Low/Low | |

Increased power and heating prices due to transition to zero-carbon energy sources | Increased office maintenance costs | Below average/Below average | Switching employees to remote working during winter |

New regulations limiting greenhouse gas emissions | Increased costs due to the implementation of emissions purification technologies. Decreased production due to the introduction of emissions targets | Low/Low | Establishing carbon reporting procedures. Participating in national and international carbon reporting initiatives. Engaging consultants for carbon reporting |

Share of green energy in the total power costs of companies is not regulated | Lack of a clear vision on the share of green energy may hinder the growth of the carbon market | Low/Low | Partnership development with issuers |

Reputational risks | |||

Increased concerns or negative feedback of stakeholders regarding Moscow Exchange’s ESG managment | Lower demand for services and negative impact on workforce management and planning (hiring and retention), resulting in revenue decrease | Low/Low | Establishing carbon reporting procedures. Participating in national and international carbon reporting initiatives. Engaging consultants for carbon reporting |

Reduced revenue from decreased demand for services | Increased stakeholder concerns over issuers’ compliance with emissions standards or negative stakeholder feedback. Reduced investor interest due to uncertain market signals | Below average/ Below average | |

Lower investor interest | Reduction in capital availability for issuers | Low/Low | Selection of instruments for hedging financial risks associated with investing in high-risk low-carbon technologies |

Climate risk monitoring metrics were developed and implemented in third quarter of 2023.

№ /pp | Risk | Metric | Monitoring Frequency |

|---|---|---|---|

1 | Floods, snowstorms / ice rain / black ice / hurricanes, storm winds / forest fires | Number of internal/external operational risk events (ORE) affecting PJSC Moscow Exchange or other Group companies, caused by extreme weather conditions in Moscow over the period. General statistics on occupational/non-occupational injuries. | Once a year |

2 | Extremely hot / cold weather | Number of internal/external ORE affecting Moscow Exchange or other Group companies, caused by prolonged extremely low/high temperatures in Moscow (lasting more than 14 days). | Once a year |

3 | Power outages and emergencies due to insufficient energy system reliability | Share of renewable energy sources (RES) in electricity consumption in Russia. | Once a year |

Number of cases causing power outages and emergencies due to the transition to low-carbon technologies. | Once a year | ||

4 | High electricity costs | Share of RES in electricity consumption in Russia. | Once a year |

5 | Expanded obligations for emissions reporting | Number of fines for concealing greenhouse gas (GHG) emission data (law becomes effective from July 1, 2025). | Once a year |

6 | Introduction of GHG emission limits | ||

7 | Absence of clear legal standards for regulating carbon emissions | ||

8 | Inaccurate or fraudulent GHG emission disclosure leading to fines and loss of consumer trust | ||

9 | Revenue decline due to reduced demand for services | Number of stakeholder complaints related to the environmental agenda. | Once every six months |

10 | Investments in inefficient technologies that do not significantly reduce GHG emissions | Share of Moscow Exchange’s investments in buildings and equipment with low energy efficiency ratings (E, F, G). | Once a year |

11 | High costs during the transition to low-emission technologies | ||

12 | Changes in investor behavior | Share of PJSC Moscow Exchange issuers providing ESG reporting. | Once every six months |

13 | Decline in demand and prices for energy resources due to the energy transition to carbon-free sources | Share of instruments issued by energy resource exporters in the Moscow Exchange Index. | Once a year |

14 | Increased stakeholder concern / negative feedback due to Moscow Exchange’s ESG approach | Number of stakeholder complaints related to Moscow Exchange’s ESG policy. | Once a year |

15 | Rising electricity and heating costs due to the shift to carbon-free energy sources | Share of renewable electricity in Moscow Exchange’s energy consumption structure. | Once a year |

16 | New disclosure requirements for GHG emissions hindering securities issuance by issuers | 1. Number of issuers that failed to issue securities due to lack of GHG emission disclosure. 2 2. Number of issuers excluded from the list due to the climate agenda (reduction of the trading list; non-compliance with regulator reporting requirements). | Once a year |

17 | Increased tax expenses for issuer companies | Share of Moscow Exchange issuers exporting to the European Union affected by cross-border carbon regulations (full implementation of the mechanism in the EU starting in 2026). | Once a year |

Climate-related opportunities | Probability of small/large magnitude risk | Description of impact indicator |

|---|---|---|

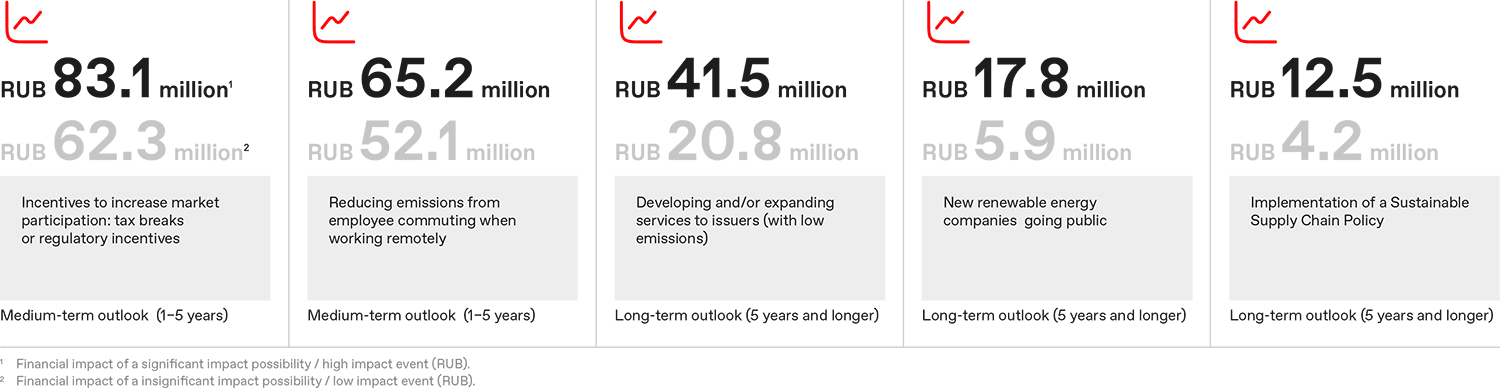

Developing and/or expanding the list of services to issuers (with low emissions) | Below average / below average | Providing additional incentives for issuers with low emissions, leading to an increase in trading turnover for these issuers and increasing income for Moscow Exchange |

External incentives to use more efficient types of transport | Average / above average | Reducing the administrative costs of Moscow Exchange |

Reducing emissions from employee commuting when working remotely | Above average / high | The development of working from home will mitigate physical climate risks, reduce indirect greenhouse gas emissions (Scope 3) by eliminating the need for employees to travel to work, and reduce the administrative costs of MOEX and by saving electricity and heat consumption to support employee activities in company offices |

External incentives to reduce electricity and heat consumption | Above average / high | Reduced office maintenance costs |

Implementation of a Sustainable Supply Chain Policy | Below average / average | Incentives for low-emission companies will reduce operating costs and increase profits/capitalisation, which will have a positive impact on trading volume |

Incentives to increase market participation, such as tax breaks or regulatory incentives | Below average / average | |

Development of new services such as climate-related indices, education and training for the market | Above average / high | Creation of services such as the new indices will help to increase revenues from the sale of market data |

The development of the market for carbon units | Above average / above average | Developing the carbon market will create a new business segment that can generate revenues on a par with other segments |

Recognising the contribution of MOEX to climate protection by society | Below average / below average | Recognising MOEX’s contribution to climate protection will increase trust in the company and attract additional customers |

New renewable energy companies going public | Below average / average | Creation and development of new industries will increase company revenues through economic growth in the Russian Federation |

ESG consulting | Below average / average | Elaboration of a climate agenda / training / advice for market participants |

The objectives related to the development of the climate risk management system in 2025 will include the following areas.

- Improving the methodology for managing climate risks and opportunities, taking into account the recommendations of the Bank of Russia on accounting for climate risks for financial institutions (letter of the Bank of Russia dated December 4, 2023).

- Developing the tools for managing climate risks and opportunities applied in 2024, including improving the assessment of climate risks and opportunities, as well as scenario analysis.

- Monitoring climate risk metrics.

- Disclosing ESG metrics in accordance with the recommendations of the Bank of Russia on the disclosure of information in the field of sustainable development by financial institutions.